Celebrating 20 Years of Impact

Clearinghouse CDFI

Douglas J. Bystry

PRESIDENT & CEO

Clearinghouse CDFI

Gary Dunn

CHAIRMAN OF THE BOARD

Clearinghouse CDFI

Financial lending for projects with measurable impacts.

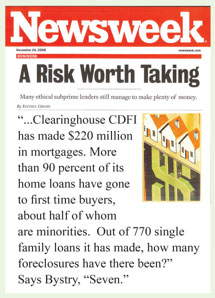

Twenty years ago, when Clearinghouse CDFI was just an idea, we could never have imagined what we would accomplish over the next two decades. When faced with challenges, we did not quit. We reminded ourselves instead that hard work, collaboration, and the dedication of people can make almost anything possible. Together, we achieve our goals to build healthy communities, provide innovative solutions, create financial strength, and fund dreams for tomorrow.

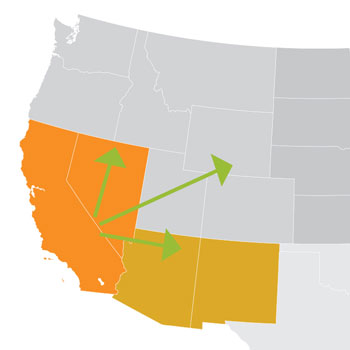

Building healthy communities

Building healthy communities requires hard work, patience, and the dedication of our staff and borrowers. Since inception, we have funded over $1.4 billion to 1,781 community projects. These projects have benefited over 600 separate underserved communities throughout California, Nevada, Arizona, New Mexico and Native American Reservations.

Clearinghouse CDFI helps borrowers achieve success in low-income communities where credit is difficult to obtain. Together, we have cumulatively impacted over 1.5 million people and rehabilitated over 15 million square feet of blighted properties. Over 7,000 low-income residents now reside in safe and affordable homes, and over 16,000 individuals now hold permanent, living-wage jobs as a result of our lending.

Providing innovative solutions

Clearinghouse CDFI has always been innovative and creative. We were incorporated as a for-profit CDFI and were the first non-depository CDFI to borrow from the Federal Home Loan Bank System. We were also the first CDFI in the nation to receive an S&P rating, and the first non-native CDFI to commit significant resources to Indian Country credit needs. As we have grown over the last two decades, so too has our capacity to meet the various credit needs of our communities.

Clearinghouse CDFI has deployed $118 million through the Bond Guarantee Program and been awarded $538 million of NMTC Allocation for disadvantaged communities. By combining unique funding sources and working to thoroughly understand our borrower’s needs, we have developed a lending strategy that offers sustainable and impactful solutions.

Creating financial strength

Financial strength and self-sufficiency has always been a cornerstone of our corporate culture. Our lending is structured to ensure financial strength and growth for our borrowers as well. Total lending volume for the year was a record high level, with $146 million in new loans originated. 2016 marked our 17th consecutive year of profitability. For the 12th consecutive year we issued a dividend on our Class A shares. Our total asset size increased by 34% to approximately $364 million.

In 2016, new and existing shareholders invested an additional $4.8 million in new Class A equity shares, the most in any year of our existence. This investment grew Stockholder’s Equity by 14.5% – a remarkable achievement providing us with needed capital for our future growth. Our ability to raise new equity is a testament to our vision and a demonstration of shareholder trust in our financial strength and future growth.

Funding dreams for tomorrow

Our mission and vision have guided us unfailingly over the past 20 years. As we continue to provide innovative solutions and create financial strength for our borrowers, we remain proudly committed to building healthy, sustainable communities. Thanks to your invaluable partnership and support, along with the hard work and dedication of our staff, we have achieved far more than we could have ever imagined. Clearinghouse CDFI now has two decades of measurable impact to show for all of our efforts. Today, we proudly reflect upon our past 20 years of success, and we look forward to continuing our tradition of impactful lending.

2016 Featured Projects

McCurdy Charter School

Española, NM

First New Mexico Loan

$5.79 Million Loan

McCurdy Charter School provides quality, tuition-free education for children in the Española Valley. As New Mexico’s largest charter school with an enrollment of over 500 students, McCurdy Charter School consistently academically outperforms local public schools.

Clearinghouse CDFI provided a $5.79 million leverage loan to Charter School Development Corporation for McCurdy Charter School to construct an additional school building, and to renovate existing buildings to current standards.

The new and renovated buildings will allow McCurdy Charter School to expand enrollment. This project will create over 50 full-time jobs.

over 500 students

enrolled in New Mexico’s Largest Charter School, who consistently academically outperform local public schools

$5.79 million Loan

to construct an additional school building and to renovate existing buildings

Eclipse Cinemas

Las Vegas, NV

Commercial & Retail Space

$2.5 Million Loan | $8.3 Million of NMTC Allocation

Eclipse Cinemas is the development of vacant land into a one-stop, downtown entertainment complex. The vibrant commercial and retail space will attract an estimated 4,400 individuals weekly to help revitalize a severely distressed area in Las Vegas, NV.

Clearinghouse CDFI provided both Federal and State New Markets Tax Credit allocation, along with a $2.5 million subordinated loan for this $21.1 million new construction project. Development of the 72,000 sq. ft. facility created 200 construction jobs and 81 full-time jobs.

Eclipse Cinemas will work with community partners to provide on-the-job training for employees. Five percent of net profits from the cinema will be donated to local charities.

THAT Brewery

Pine, AZ • Cottonwood, AZ

NEW, LARGER-SCALE FACILITY

Financing Partnership

THAT Brewery is an Arizona small business offering specialized, award winning craft beers throughout the Phoenix Metropolitan area.

Arizona MultiBank, a Division of Clearinghouse CDFI, partnered with the Arizona Commerce Authority to provide financing to THAT Brewery to establish a new, larger-scale production facility in the rural community of Cottonwood, AZ, and for preservation of their existing restaurant and brew pub in Pine, AZ.

THAT Brewery serves rural Arizona while embracing environmentally friendly efforts. These efforts include recycling used oil for biodiesel fuel and contributing a portion of revenue towards the conservation of an 800-mile trail linking deserts and mountains.

Clearinghouse CDFI Loans: Financing Partnership

A portion of revenue from ale beer will be donated toward preserving national scenic trails.

One World Beef

Brawley, CA

NEW FACILITY, NEW JOBS

$5 Million Loan

One World Beef (OWB) is a meat packing and processing company focused on bringing transparency to the meat distribution industry. Concentrating on quality rather than speed, OWB employs sustainable meat distribution and processing practices.

Clearinghouse CDFI financed a $5 million loan for OWB to acquire and improve a previously shut down meat distribution facility, and implement updated sustainable processes. This includes an increase in food handling safety and traceability of the meat throughout the process.

The acquisition of the new facility will create 225 full-time jobs and 20 construction jobs in the severely distressed area of Brawley, CA.

Clearinghouse CDFI Loans: $5 Million Loan

New facility acquired, 225 full-time jobs created.

Landmark

San Francisco, CA

NEW FACILITY, NEW JOBS

Over $2.1 Million Loan

Landmark is a 100-year-old, historically registered building located in San Francisco, CA. Formerly serving as a church, the building had been left unoccupied and in poor condition for several years.

In 2016, Clearinghouse CDFI provided over $2.1 million in financing for the rehabilitation of the formerly dilapidated historic building into a flourishing community center. Originally built in 1913, the renovated space will feature a large scale office building, cafe, and a meeting hall.

Restoration of the new space includes preservation of current historical features, as well as updating of internal spaces. This project will generate 290 permanent, living wage jobs and 50 construction jobs.

Clearinghouse CDFI Loans: $2.1 Million Loan

290 living wage jobs created.

Looking Back: Then & Now

American Family Housing

Throughout Southern CA

First Loan Funded in: 1998

Financing: $976,000

Formerly known as Shelter for the Homeless, American Family Housing is a nonprofit organization that offers affordable housing services to support homeless and low-income families.

Including our very first loan in 1998, Clearinghouse CDFI has provided over $976,000 in financing to American Family Housing for the acquisition and rehabilitation of affordable housing in distressed communities throughout Southern California.

Today, American Family Housing operates over 250 housing units that provide safe, affordable homes for families and recently opened a new shelter, Potter’s Lane, in Midway City.

The Fox Theater Pomona

Pomona, CA

Funded in: 2010

Financing: $9.05 Million of NMTC Allocation & Equity

The Fox Theater Pomona is a multi-purpose entertainment venue located at the center of downtown Pomona. Originally built in 1931, the theater was vacant for 10 years.

Clearinghouse CDFI provided over $9 million of NMTC allocation and equity for the acquisition and rehabilitation of this historic theater.

Today, the new Fox Theater Pomona is an Art Deco landmark and state-of-the-art entertainment venue with a concert hall, full-service restaurant, bar and lounge.

New Solutions

Riverside, CA

Funded in: 1999

Financing: $1.1 Million

New Solutions began in 1995 as a small, two-person start up business. Operating out of a home garage, it entered the market as “the only wheelchair parts distributor owned and operated by the disabled.”

In 1999, Clearinghouse CDFI provided $1.1 million in financing to help New Solutions expand operations into their own building. They also began purchasing wheelchair parts in bulk with permanent working capital.

New Solutions has since grown to over a dozen employees. They currently serve over 1,000 customers annually, and recently celebrated their 25th year in business. Congratulations!

Washoe Travel Plaza

Gardnerville, NV

Funded in: 2015

Financing: $10 Million of Federal NMTC Allocation, $2 Million of NV State NMTC Allocation, & a $5.6 Million Loan

Washoe Travel Plaza was constructed on Native American reservation land in Nevada. Development of the plaza created 125 living-wage jobs for residents in this low-income, tribal community.

Clearinghouse CDFI provided key financial resources in 2015 for project construction, including: $10 million of Federal NMTC allocation, $2 million of Nevada State NMTC allocation, and a $5.6 million loan to the Washoe Tribe.

Now open, the new 6,000 sq. ft. Washoe Travel Plaza provides a critical and sustainable source of revenue for the Washoe Tribe.

Brilliant Corners

Throughout CA

First Loan Funded in: 2008

Financing: $15.7 Million

Brilliant Corners is a nonprofit organization that provides affordable, community-based supportive housing for people with special needs.

Since 2008, Clearinghouse CDFI has financed multiple loans to help Brilliant Corner’s acquire and rehabilitate 26 single-family homes. These homes offer critical services and affordable rental housing for individuals with developmental disabilities.

Today, Brilliant Corners serves over 700 people, who have transitioned from homelessness or institutionalization toward independence.

Market Creek Plaza

San Diego, CA

FUNDED IN: 2011

FINANCING: $15 Million of NMTC Allocation

Market Creek Plaza is a shopping/community center that was conceived, constructed, and owned in-part by local residents. Built on the site of a 20-acre abandoned factory, revitalization began in 1998.

In 2011, Clearinghouse CDFI provided $15 million of NMTC allocation to establish this thriving grocery market in a distressed area of San Diego.

Today, Market Creek Plaza is home to several locally owned businesses and restaurants. A diverse community focal point, it combines a myriad of cultural traditions, art, and entertainment with necessary products and services, and the pride of local ownership.

2016 Impacts

1.5 Million

Clients Served

Since Inception

7,200 Affordable Housing Units

Since Inception

1,781 Total Projects Funded

Across CA, NV, AZ, NM, and Sovereign Nations

16,000 Student Spaces

Created or Retained

Since Inception

9,000+ Construction Jobs

Created or Retained

Since Inception

$1.4 Billion Cumulative Lending

Since Inception

Over Half of All Loans to Organizations With Environmentally Sustainable Efforts

In 2016

480 Loans to Non-Profits Totaling $341 Million

Since Inception

$538 Million NMTC Allocation Awarded

Since Inception

6,000 Permanent Jobs

Created

Since Inception

15 Million Square Feet

Developed or Preserved

Since Inception

2 Out Of 3 Loans Funded to Women or Minority Owned Organizations

In 2016

– Memorable Moments –

20 Years of Impact – A Timeline

Clearinghouse CDFI incorporates as a for-profit corporation

First offering closed: $1 million equity, $10 million loan funds

First year of profitability -- three years ahead of schedule

Clearinghouse CDFI receives Second CDFI Fund Core Award: $1.5 million

Awarded first New Markets Tax Credits allocation: $56 million

Cumulative lending exceeds $100 million

First dividend is issued to Clearinghouse CDFI shareholders

Total assets reach $62 million

Cumulative lending exceeds $600 million

Cumulative Lending Reaches $1 Billion

Clearinghouse CDFI Receives $80 Million of NMTC Allocation and $8 million of Nevada State NMTC Authority

$2.7 Million Class A Shares Issued

Clearinghouse CDFI Receives B Corp Certification

Clearinghouse CDFI becomes the 1st CDFI to Obtain a Rating Rrom S&P Ratings: 'AA' Stable

2nd $100 Million Bond Closed Through the CDFI Fund Bond Guarantee Program

Awarded PLATINUM & FIVE STAR Scoring in Global Impact Investing Rating System

Cumulative Lending Reaches $1.4 Billion

Looking Forward to the Next 20

Thank you to our partners, shareholders, staff, and friends who have been there with us for the past 20 years. Together, we have achieved more than we ever imagined possible.

We look forward to working together over the next 20 years to continue helping our communities thrive.

Partners & Staff

Our Team

Douglas J. Bystry

President / CEO

Alan Orechwa

Chief Financial Officer

Kristy Ollendorff

Chief Credit Officer

Jay Harrison

Chief Investment Officer

Brian Maddox

Chief Production Officer / Director of NV Operations

Andrew Gordon

Arizona Market President

Kathy Bonney

Officer Manager / Executive Assistant to CEO & CIO

Melissa Brown

Portfolio Manager

Colin Wegener

Financial Reporting & Compliance Manager

Lundi Chea

NMTC Asset & Compliance Manager

Mai Nguyen Ha

Impact Manager

Avery Ebron

Community Impact Analyst

Amy Maali

Commercial Loan Funder Manager

Guy Krikorian

Controller

Alanna Smith

Director of Marketing

Michelle Taylor

Loan Servicing Manager

Chris McMartin

Underwriting Manager

Amanda Virrey

Commercial Underwriter

Randy Dixon

Senior Small Business Underwriter

Peter Ahjohn

Sr. Commercial Underwriter

Tyler Hagen

Commercial Loan Specialist

Sabrina Sharif

Marketing Specialist

Natalie Tomasik

Marketing Assistant

Debra Kramer

Construction Loan Specialist Manager

Fathia Macauley

Director of Business Development Nor. Cal.

Susan Beers

Market Representative So. Cal / San Diego

Ricky Ha

NMTC Accountant

Lacey Dixon

Loan Processor / Administrative Assistant

Julie Jongsma

Senior Accountant

Roscelle Shands

Loan Servicing Assistant Manager

Lauren Manalili

Loan Servicing Specialist

Pearl Curbelo

Production Assistant NV

Cesar Plascencia

Office Coordinator

Cindy Farney

Administrative Assistant

Brenda Rodriguez

AHC Executive Director

Leonardo Carrillo

AHC Housing Specialist

Janell Abarca

AHC Sr. Housing Counselor

Boards & Committees

Board of Directors

- Gary Dunn Banc of California

- Susan Montoya First Bank

- David Levy Fair Housing Council of OC

- Henry Walker Farmers & Merchants Bank

- Pat Neal Neal Estate, Inc.

- Ray Nayar AOF/ Pacific Affordable Housing

- Glen Pacheco ProAmerica Bank

- Alva Diaz Wells Fargo

- Mark Rebal California Republic Bank

- Jacky Alling Arizona Community Foundation

- Jeff Talpas BBVA Compass

- Carol Parry Fox Corporate Social Responsibility Corporation

- Terrin Enssle Banc of California

- Keith Thomas Royal Business Bank

- Cloyd Phillips Community Services Agency Development Corporation

Member Highlight

Partner since 2005

The areas that Clearinghouse CDFI goes into in producing commercial housing, multi-family housing, and childcare centers; those are all things that contribute to the health of a community and to the economy.

Loan Committee

- Alan Orechwa Clearinghouse CDFI

- Glen Pacheco ProAmerica Bank

- Laura Green First Foundation Bank

- Wesley Wolf Wolf & Company, Inc.

- Waheed Karim US Bank

- Gary Dunn Banc of California

- Patricia Dixon Plaza Bank

- Dino Browne Las Vegas Urban League

- Melody Winter Head Federal Reserve Bank of San Francisco

Member Highlight

Partner since 2002

Clearinghouse CDFI continues to foster the same ‘homegrown’ feel it had from its early beginnings, despite being a major force in the field of community development finance. That’s why I stay plugged in!

New Markets Tax Credit Advisory Board

- David Levy Fair Housing Council of OC

- Mike McCraw R.M. McCraw & Associates

- Raymond Turner Temple MissionaryBaptist Church

- Andrew Michael Partnership for Change

- Karlene Hunter Native AmericanNatural Foods

- Tim Johnson City of Federal Way

- Alan Woo Community Action Partnership of Orange County Retiree

- Stanley Tom Valley Business Develoment Corporation

- Delores Brown Community Development & Associates

Member Highlight

Partner Since 2003

I am amazed at the caliber of CDFI staff and their knowledge and their ability to bring economic vitality back to communities where prosperity is denied, access to credit is limited and where other financial institutions lack the confidence to invest.

Asset Review Committee

- Glen Pacheco ProAmerica Bank

- Mark Rebal California Republic Bank

- Elsa Monte Pacific Western Bank

- Terrin Enssle Banc of California

- John Marder First Bank

- Wilson Mach First General Bank

- David Sharp Pacific Western Bank

- Lorena Mendez-Quezada Wells Fargo

Member Highlight

Partner Since 2011

As a member of the Asset Review Committee, it is an honor to be a steward for the capital that Clearinghouse CDFI brings to underserved communities.

Arizona Board of Advisors

- Douglas J. Bystry Clearinghouse CDFI

- Andrew W. Gordon Arizona MultiBank, a division of Clearinghouse CDFI

- Tim R. Bruckner Alliance Bank of Arizona

- Paul T. Hickman Arizona Bankers Association

- Sandra Watson Arizona Commerce Authority

- Mark Van Brunt National Council of La Raza

- Craig K. Williams Snell & Wilmer LLP

- Michael P. Lefever Wells Fargo Bank

- Carol Parry Fox Corporate Social Responsibility Corporation

- John V. Prince Highland Financial Consulting

- David Castillo Native Capital Access

- Jonathan Koppell ASU School of Public Service & Community Solutions

Member Highlight

Partner Since 2014

I am pleased to serve on the Arizona Board of Advisors for Clearinghouse CDFI. We are passionate about seeing our state benefit from expanded access to credit in underserved communities.

Asset Liability Management Committee

- Terrin Enssle Banc of California

- Susan Montoya First Bank

- David Levy Fair Housing Council of OC

- Craig Kardokus First Foundation

- Steve Herman California Bank and Trust (Zions)

- Michael Solomon Charles Schwab Bank

Member Highlight

Partner Since 2006

Our ALCO Committee members are a group of sharp and insightful individuals. We are always working together to serve the credit needs of our underserved communities

Arizona Investment Committee

- Andrew W. Gordon Arizona MultiBank, a division of Clearinghouse CDFI

- Alan Orechwa Clearinghouse CDFI

- Tim R. Bruckner Alliance Bank of Arizona

- Esperanza Martinez National Bank of Arizona

- Edward Celaya Mutual of Omaha Bank

- Cyndi Franke-Hudson Wells Fargo Bank

Member Highlight

Partner Since 2013

I am proud to have been involved with Arizona MultiBank for 20 years. Now, as a division of Clearinghouse CDFI, the combined resources will allow for greater impact in Arizona’s communities.

Native American Advisory Board

- David Murray Native Capital Access

- Gerald Sherman Bar K Management

- Karlene Hunter Native American Natural Foods

- Shawn Nelson Father Sky & Mother Earth Art

- Chumahan Bowen Law Office of Chumahan Bowen

- Bob Crothers Citizen Potawatomi Community Development Corporation

Member Highlight

Partner Since 2016

I am honored to be a member of the Native American Advisory Board for Clearinghouse CDFI and pleased to help provide appropriate financial services to Native and other underserved communities.

CREC Committee

- Kristy Ollendorff Clearinghouse CDFI

- Mark Rebal California Republic Bank

- Michael Schrim Pacific Western Bank

- Bryan Shaffer George Smith Partners

- Mitchell Thompson Thompson Consulting

Member Highlight

Partner Since 2011

It has been an honor to serve on the CREC Committee for Clearinghouse CDFI. I look forward to helping bring and provide more credit to underserved communities.

Investors

Highlights With Our Staff from the Last 20 Years

Memorials

Financial Information

Click For Information

Core Lending Volume

Lending is highly personal to the staff of Clearinghouse CDFI. We know that our work is changing lives and transforming communities otherwise largely absent of investment. Each loan request is reviewed by our team of professionals who work tirelessly to structure every loan for success.

As we have expanded into new territories over the past year, we find an even greater demand for Clearinghouse CDFI lending. Thanks to the continued support of our community partners and institutional investors, Clearinghouse CDFI continues to successfully meet this demand head on.

The accelerated growth of Clearinghouse CDFI in the last two years has propelled us to new heights that we only dreamed of achieving 20 years ago. Our increase in capital raising has allowed for more aggressive funding targets and market expansion. We remain true to our roots of funding unserved markets and constantly push for innovative products that are not found elsewhere in the market. I look forward to seeing where the next 20 years leads us.

– Kristy Ollendorff, Chief Credit Officer

Mini Q&A

-

How does Clearinghouse CDFI critically impact our communities?

-

20 Years of Memories

-

What makes Clearinghouse CDFI unique?