Bridging Divides in Community Finance

Prior to 1957, residents and tourists of Michigan faced a significant divide. The journey between the state’s upper and lower peninsulas was challenging. The only options were to either take a long roundabout route by road or brave the unreliable ferry services. Harsh Michigan winters exacerbated these difficulties, often rendering travel inconvenient or impossible. This bottleneck affected thousands daily, creating a clear need for a solution that could bridge this daunting gap. In response to this challenge, engineers constructed the Mackinac (pronounced Mackinaw) Bridge – a marvel spanning 26,372 feet (5 miles) and now making this passage accessible to over 4 million vehicles each year.

Like the Mackinac Bridge, Clearinghouse Community Development Financial Institution (Clearinghouse CDFI) stands as a vital bridge in the financial sector. Our mission, like that of the Mackinac Bridge, aims to connect, assist, and transform.

In the world of community development, Clearinghouse CDFI’s financial solutions connect the lower and upper peninsulas of opportunity and accessibility. Our impact is measurable and significant, just like the millions of vehicles that now smoothly make their way across the Mackinac each year.

Since 1996, Clearinghouse CDFI has been the architect of financial pathways, ensuring safe and reliable passage for dreams and ambitions that once seemed distant. Through our direct lending and mission-driven approach, we’ve created a means for economic growth and community empowerment. Our mission is not just about bridging physical distances but about overcoming economic divides, ensuring that every community has an opportunity for success.

Direct Lending: Bridging the Gap

Clearinghouse CDFI is a direct lender, providing straightforward financial support to community-focused projects and businesses. Direct lending is lending money directly to someone for a specific purpose without involving a middleman. Imagine a friend or neighbor wants to start a small business, and instead of going to a big bank, they come straight to you. You give them the money they need; they use it for their project, and then they pay you back over time. As a direct lender, Clearinghouse CDFI streamlines funding to impactful community projects like affordable housing and community facilities, ensuring an efficient contribution to community development.

Direct lending is not just our business model—it’s our method of connecting dreams with reality. Just as a bridge is engineered to connect two pieces of land together, our direct lending services are designed to bridge economic gaps ensuring:

To ensure the effectiveness of our approach and measure our success, our Impact Department led by Mai Ha, plays a crucial role. Reflecting on the department’s work, Mai shares, “When I first started here, I was an impact analyst. When there was no impact department… but it has always been really important.” This commitment has grown over time as Mai elaborates, “So now we are a team of five, including myself.” This department meticulously tracks and evaluates the tangible outcomes of our loans, ensuring that our mission of bridging economic divides and fostering community development is consistently met.

The Why and How of Impact Tracking

Mai Ha, Director of Impact

At Clearinghouse CDFI, impact tracking is how we ensure the bridges we build in the community are strong, effective, and serving their purpose. Mai emphasizes the thoroughness of this process: “There are over 150 data points per loan for Impact itself. And that includes things likethe number of clients served; number of jobs created; number of affordable housing units created or retained in addition to data from the census track…like what’s the employment rate in that area? What’s the poverty rate? What’s the median income? That really gives context to the impacts that we’re making with the project.”

With over 150 fields of data per loan, we’re not just scratching the surface; we’re delving deep to understand the ripples of change our loans generate. This process is critical to our operations for several reasons:

- Validating Effectiveness: Every loan we make promises progress, and through impact tracking, we ensure the fulfillment of these promises. Through rigorous analysis of over 150 data points per loan, we ensure each project we finance yields the desired community benefits. This depth of data provides us with a comprehensive understanding of the impact of our loans, from job creation to housing development.

- Guiding Strategic Decision-Making: Our path is charted by the data we gather. By understanding the outcomes of our loans, we can refine our strategies, ensuring that our future projects are even more impactful. This data-driven approach helps us identify underserved areas and adapt our tactics to meet evolving community needs. We’re not just following trends; we’re using concrete evidence to forge paths that lead to sustainable economic growth and community development.

- Building Trust with Stakeholders: We build and maintain trust with all stakeholders through our detailed tracking and transparent communication of these outcomes, demonstrating our commitment to not just envision change but to actively achieve it. Our stakeholders can see the tangible results of their involvement, reinforcing their confidence in our mission and methods.

Our Impact Department ensures we go beyond superficial measures, diving deep into the data to capture the true ripples of change our loans generate in communities. At Clearinghouse CDFI, we focus on making an impact that is not just felt today but continues to resonate and expand into the future.

This proactive use of impact data seamlessly leads into the ethos that drives every action we take at Clearinghouse CDFI. At the heart of our data analysis and strategic decision-making lies our fundamental identity: Clearinghouse CDFI is more than just a lender—we are a mission-driven institution committed to making a lasting difference in the communities we serve.

To listen to Mai give a full breakdown of Clearinghouse CDFI's Impact Department, listen to Episode 6 of Funded! by Clearinghouse CDFI

The Soul of a Mission-Driven Lender

Being mission-driven at Clearinghouse CDFI is the very essence of our operations. It embodies our steadfast belief that finance is not just about money; it’s a powerful tool for supporting equitable growth and building a better future for all. Our approach is rooted in a deep understanding that financial services can and should be a force for good, creating bridges to opportunities and a brighter tomorrow for communities often overlooked by traditional finance.

Being mission-driven is about focusing on more than just financial transactions. It’s about understanding and supporting the hopes, dreams, and aspirations of the people we serve. For us, it means being as committed to the success of our borrowers’ projects as they are themselves.

Ultimately, our mission-driven approach is the core of our identity at Clearinghouse CDFI. It’s about more than just financial transactions; it’s a commitment to making a genuine human impact, where we act as both allies and advocates for those we serve.

Mai Ha explains the natural alignment with the B Corp philosophy: “For us, it was really natural to become a B Corp because we’re mission-based. We’re also for-profit, and that’s what a B

Our status as a Certified B Corp is not just a label; it represents our dedication to being part of a global movement of organizations that use business as a force for good. This distinction recognizes our commitment to adhering to the highest standards of verified performance in all aspects of our operations, from social engagement to environmental stewardship. Being a B Corp aligns with our mission to see beyond the balance sheet and actively contribute to a sustainable and equitable future.

Decoding the B Impact Assessment

Certified B Corps, like Clearinghouse CDFI, are recognized for their commitment to using business as a force for good. The B Impact Assessment (BIA) is our report card, reflecting how we fare against rigorous standards of social and environmental impact.

For Clearinghouse CDFI, the BIA serves as a powerful tool for self-assessment, benchmarking, and improvement. It allows us to:

- Objectively assess our sustainability and social impact practices.

- Benchmark our performance against thousands of other businesses, identifying strengths and areas for improvement.

- Develop strategic plans for enhancing our business’s positive impact.

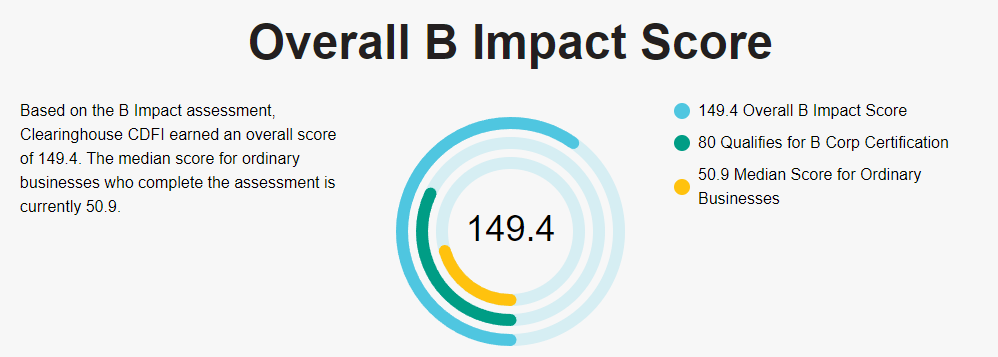

At Clearinghouse CDFI, our BIA score of 149.4 is more than just a number; it’s a reflection of our unwavering dedication to social and environmental impact. As Mai explains, “We scored 149.4 on our last assessment, and you have to score an 80 to become certified as a B Corp. An ordinary business typically scores around 50.9, which means we’ve not only surpassed the certification requirement but have achieved a score more than three times higher than the average business.”

This exceptional score is a testament to how we surpass the standards set by the B Corp community, underscoring our role as a significant force for positive change. Our commitment goes beyond just meeting expectations. “Our performance puts us in context of not just being good enough, but being exceptional for our communities and the environment,” Mai elaborates. This dedication to excellence is not just a set of values we boast on our website; it’s realized in every project we undertake and every community we impact, consistently striving to exceed the norms and set new benchmarks in community finance.

The Community Impact: A Story of Numbers and Narratives

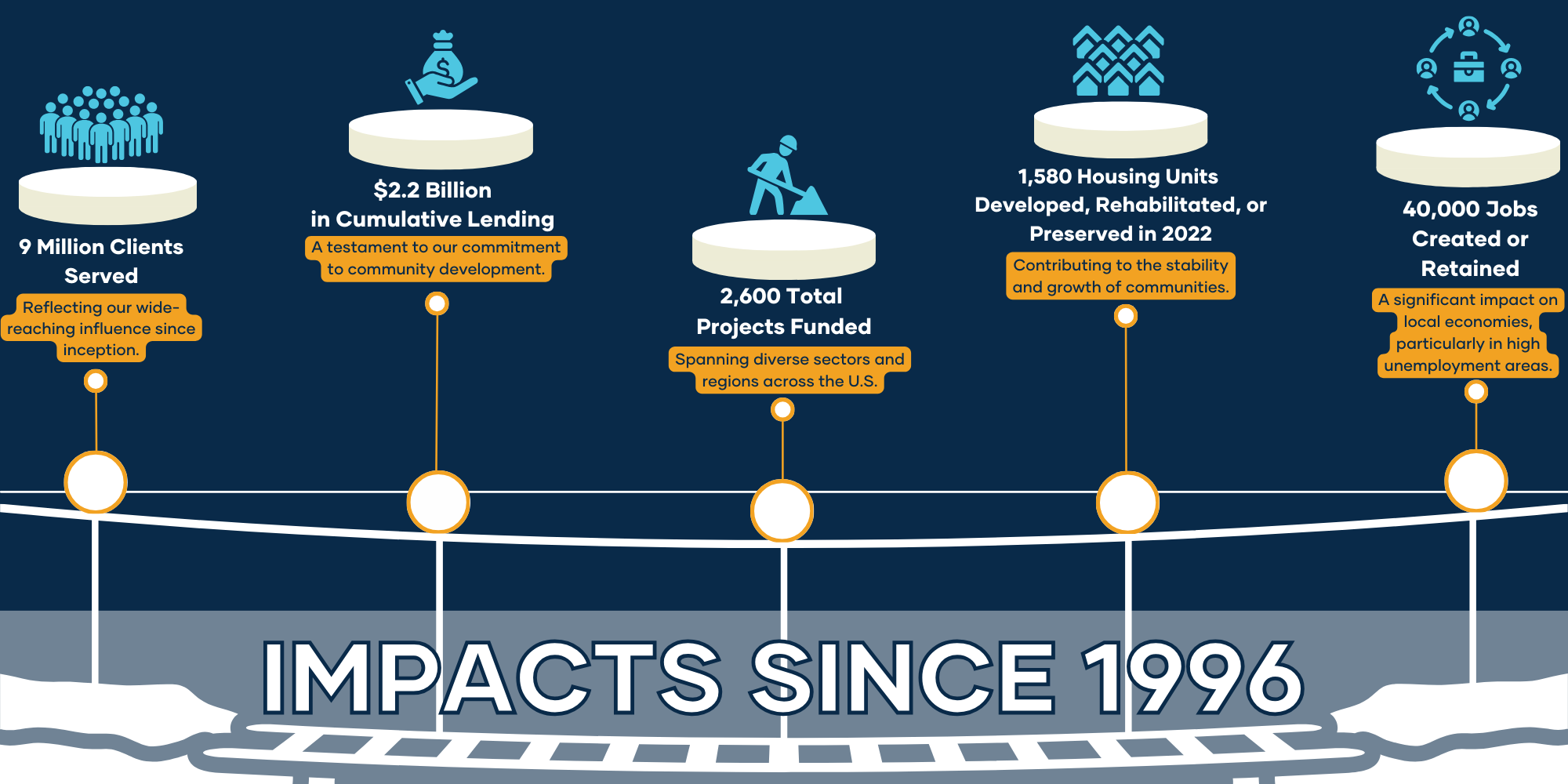

“Think about a football stadium or a large concert. That’s about 100,000 seats. Now imagine 39 of those football stadiums brimming with people—that’s how many lives we’ve touched since inception,” visualizes Mai as she reflects on the reach of our work. That number is more than just a statistic. Our impact tells a story of empowerment, opportunity, and hope interwoven through the very communities we serve.

Our journey of impact is marked by significant milestones since inception in 1996:

- 9 Million Clients Served: Reflecting our wide-reaching influence since inception.

- $2.2 Billion in Cumulative Lending: A testament to our commitment to community development.

- 2,600 Total Projects Funded: Spanning diverse sectors and regions across the U.S.

- 1,580 Housing Units Developed, Rehabilitated, or Preserved in 2022: Contributing to the stability and growth of communities.

- 40,000 Jobs Created or Retained: A significant impact on local economies, particularly in high unemployment areas.

Each figure carries stories of positive change – from providing affordable housing to empowering small businesses and beyond. These numbers are more than just marks of achievement; they are testimonies of the lives changed and communities transformed through our loans.

To explore these stories and delve deeper into our diverse impact across various categories, visit our Impact Map.

A Beacon of Change in Community Finance

In 1957, the Mackinac Bridge was constructed to bridge the gap between peninsulas for the state of Michigan. In 1996, Clearinghouse CDFI was founded to bridge the gap between dreams and reality in underserved communities.

That bridge (which happens to be the longest in the Western Hemisphere) and Clearinghouse CDFI (who happens to be one of the largest CDFI’s in the nation) share mirrored journeys that have been marked by resilience, determination, and an unwavering commitment to our mission. Like this iconic bridge, we have weathered challenges and emerged stronger, proving that financial endeavors can indeed be a powerful force for social good and environmental stewardship.

As we look to the future, we strive to remain more than just a lender – we are for-profit and for-people, embodying the belief that these two elements go hand in hand to create a more inclusive and prosperous world. We continue to lay down the framework of opportunity, support, and empowerment, ensuring that every project we finance contributes to a more connected and thriving community. Like the mighty spans of the Mackinac, we bridge dreams and reality, aspirations and achievements.